Debt Market Review

Mr. Avnish Jain

Head - Fixed Income

Macro Review & Fixed Income Market Outlook

Global Economy Update:

Macro Backdrop: The global outlook for 2023 is characterised by weakening demand conditions, some lingering supply bottlenecks, and resurgent COVID infections.

Central banks are slowing the pace of monetary policy tightening as inflation grudgingly eases globally in tandem with moderating commodity prices, though it remains high and well above targets.

As a result, their forward guidance has reaffirmed their commitment to breaking inflation trend and anchoring inflation expectations.

According to the IMF, one-third of the world is likely to be in recession by 2023.

The World Bank’s latest Global Economic Prospects (GEP), released on January 10, 2023, predicts a prolonged slowdown in the global economy, with growth of 2.2% in 2023 - the third lowest in three decades.

Growth in advanced economies (AEs) has been revised downward by 170 basis points to 0.5% from June 2022 projections, while growth in emerging market economies (EMEs) has been revised downward by 80 basis points to 3.4%.

Indian Economic Growth:

Macro Backdrop: The Indian economy demonstrated resilience, with domestic drivers driving growth.

Since August, the index of supply chain pressure for India (ISPI) has fallen below historical average levels, indicating that supply responses are improving.

In consonance, the economic activity index extracted from high frequency indicators (HFIs) in a dynamic factor model showed an uptick in activity in November 2022.

As per the first advance estimates of national income released by the National Statistical Office (NSO) on January 6, the Indian economy is projected to clock a growth of 7.0 per cent in 2022-23.

Consequently, real gross domestic product (GDP) surpassed its pre-pandemic (2019-20) level by 8.6 per cent.

India’s exports, after exhibiting a remarkable recovery post-COVID with growth of 24.3 per cent in 2021-22, moderated to 12.5 per cent in 2022-23.

With the growth in imports at 20.9 per cent outpacing the growth in exports, the drag from external demand was at an unprecedented high of 7.1 per cent of GDP.

Inflation:

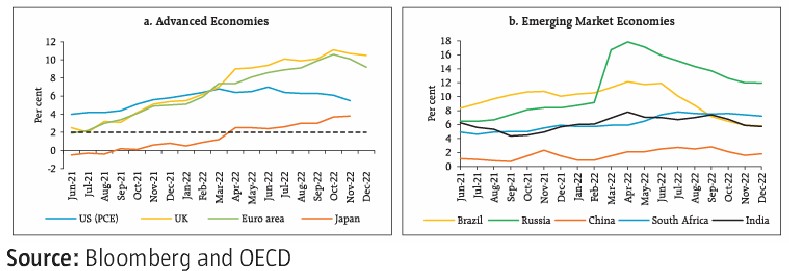

Global: The US CPI inflation eased markedly for the sixth consecutive month to 6.5 per cent in December 2022 from 7.1 per cent in November.

In the Euro area, inflation slowed to 9.2 per cent in December 2022 from 10.1 per cent in November, driven by negative momentum in energy prices.

In the UK, inflation edged down to 10.5 per cent in December 2022 from 10.7 per cent in November, led by transport prices.

Japan, on the other hand, recorded a four-decade high CPI inflation of 3.8 per cent in November.

India: CPI inflation moderated to 5.7 per cent in December 2022 from 5.9 per cent in November. The easing was primarily driven by the sharp moderation in food inflation. The Consumer Price Index declined by 45 bps month-on-month (m-o-m), which was partially offset by an unfavorable base effect (month-on-month change in prices a year ago) of 30 bps, resulting in a fall in headline inflation by around 15 bps between November and December.

Trends and Drivers of CPI Inflation:

Bond Yields & Spreads:

US FED dialled back the rate hike to 50bps in December 2022 FOMC (Federal Open Market Committee).

RBI MPC slowed as well, raising rates by 35bps in December 2022 policy meet.

US 10Y yield dropped to a low of 3.40% in January 2023.

India rate markets were fairly quiet in January, with 10Y GSEC trading in 7.30-7.40% range.

Short-term rates moved higher on the back of shrinking liquidity as well as increased issuance by Banks, leading to inversion of curve in 1-3 yr segment.

Medium to long term corporate spreads remained on lower side in absence of any material increase in supply.

Outlook:

Global: Global economy is likely to be marked by slow growth, moderating but elevated inflation, peaking policy rates, and continuing geo-political risks.

Inflation seems to have peaked in major countries, though reasons to cheer may still be far away.

The sharp rise in rates by the US FED and other central banks points to extraordinary steps needed to tame decades high inflation.

With inflation mandates of 2% in most AEs (Advanced Economies), the current inflation is still very high. AE Central banks may be reluctant supporters of growth in backdrop of unprecedented high inflation and may err on the side of caution, waiting for inflation to trend down meaningfully.

While rate hikes in major countries may end soon, rates may have to remain higher for longer to bring down inflation to mandated levels.

India: In India, macro situation is better. Growth while remaining resilient is likely to slow down to below 6% in FY2024.

The Union budget was positive for bond markets as the gross borrowing numbers of INR 15.43 Lakh Crore was lesser than expectation of around INR 16 Lakh Crore.

Net borrowing numbers were projected at INR 11.8 Lakh Crore (vs INR 11.08 Lakh Crore FY2023RE).

Fiscal deficit for FY2023 was maintained @6.4% while FY 2024 was projected @5.9%, with the FM reiterating that government’s intention to bring fiscal deficit to 4.5% by FY2026.

However, a gross borrowing number of INR 15.43 Lakh Crore remains challenging especially with liquidity surplus dwindling.

Further, corporate bonds as well as SDL supply may continue to move higher, pressuring rates.

The market will now await the outcome of RBI monetary policy committee (MPC) scheduled for next week.

While a fall in fiscal is positive for MPC committee members, a rate hike of 25bps and switch to a pause mode is expected.

With this rate hike, the RBI MPC is further likely to switch stance to “neutral”.

CPI inflation has fallen to below 6%. RBI has increased repo rate by 225bps. Expectations of another 25bps hike in Feb 2023.

Recently, INR has underperformed major currencies, as trade deficit remains high and on account of FII outflows. January 2023 saw outflows of more than INR 30,000cr in equity segment.

Source: RBI, MOSPI, CMIE, FIMMDA, NSDL, Bloomberg.