Economic Indicators (as on August 31, 2023)

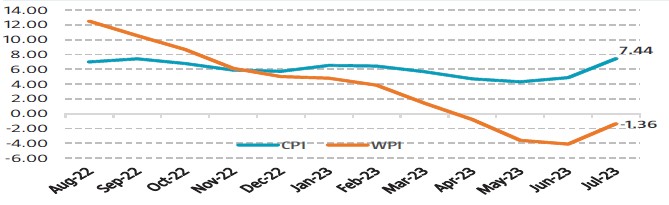

Inflation in India (%)

Consumer Price Index rises to 15 months of 7.44% in Jul’23 from 4.81% in Jun’23, largely due to rise in food inflation. The recent spike in tomato and other vegetable prices across India may be partially to blame for the most recent increase in inflation. Retail inflation is above the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) rises to -1.36% in Jul’23 from -4.12% in Jun’23, primarily contributed by rise in the prices of vegetables. WPI remained in the deflationary zone for the fourth month in a row.

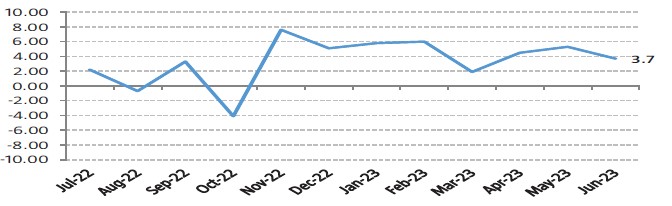

Index of Industrial Production (%)

Index of Industrial Production (IIP) declines to 3 months low of 3.7% in Jun’23 from 5.3% in May’23 primarily due to poor showing by the manufacturing sector which witnessed a growth of 3.1%. Power sector saw some improvement with a growth of 4.2% whereas mining sector grew by 7.6%.