Economic Indicators (as on April 28, 2023)

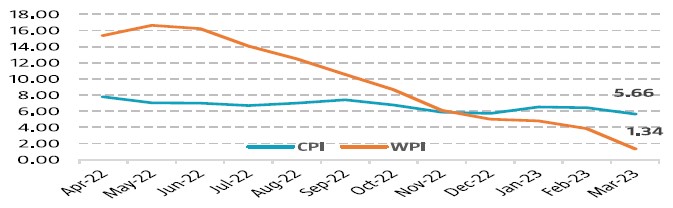

Inflation in India (%)

Consumer Price Index decreased to 15 months low, 5.66% in Mar’23 from 6.44% in Feb’23, largely due to base effect and decrease in prices of vegetables, oils, meat and fish, and lowered inflation of other food items. Retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) cools down to 29 months low of 1.34% in Mar’23 from 3.85% in Feb’23, primarily contributed by fall in the prices of manufactured items and fuel and power. This is the 10th straight month of decline in WPI-based inflation.

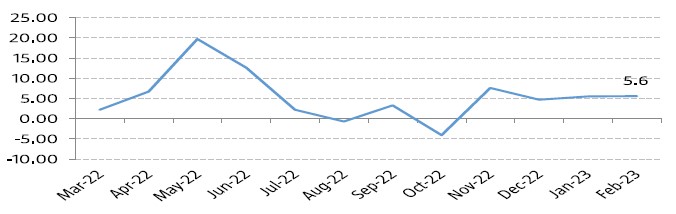

Index of Industrial Production (%)

Index of Industrial Production (IIP) rose to 5.6% in Feb’23 from 5.2% in Jan’23 primarily owing to a moderate growth in electricity output and subdued growth in mining and manufacturing. The electricity and mining sectors rose by 8.2% and 4.6% respectively, whereas the manufacturing sector increased by 5.3% in Feb'23.