Debt Market Review

Mr. Avnish Jain

Head - Fixed Income

Macro Review & Fixed Income Market Outlook

Global Economy Update:

Macro Backdrop: Global economic conditions are characterised by increased uncertainty, as financial conditions remain unpredictable and financial markets remain turbulent.

In its April 2023 World Economic Outlook (WEO), the IMF forecast global growth to fall to 2.8 percent in 2023, a 10 bps decrease from its January 2023 projection, from 3.4 percent in 2022, before stabilising at 3.0 percent in 2024-28.

Recent financial sector instability, persistently high inflation, the ongoing conflict in Ukraine and its spillovers, and the pandemic’s residual consequences, including new waves of infections, are all weighing on global economy.

The IMF also noted an alternative scenario with severe financial sector stress, which could reduce global growth to 2.5% in 2023.

Under the baseline scenario, global headline inflation is expected to fall from 8.7 percent in 2022 to 7.0 percent in 2023 (a 40 bps increase from the January forecast), while underlying core inflation may remain high for longer.

The global composite purchasing managers index (PMI) improved to 53.4 in March 2023 from 52.1 the previous month, driven by the global services PMI, which increased to 54.4 in March from 52.6 in February.

On the other hand, global manufacturing PMI declined to 49.6 in March 2023 from 49.9 a month ago due to slower growth of output and employment, and a fall in new orders and stocks of purchases.

Indian Economic Growth:

Macro Backdrop: Despite an uncertain global outlook, the Indian economy has shown signs of resilience, as evidenced by a variety of high-frequency indicators.

In India, aggregate demand is strong, aided by a resurgence in contact-intensive services.

A bountiful rabi harvest, a budgetary push for infrastructure, and a recovery in corporate investment in specific industries all bode favourably for the economy.

In response to monetary policy initiatives and supply-side measures, headline CPI inflation has gradually dropped from a high of 7.8 percent in April 2022 to 5.7 percent in March 2023, and is expected to fall further to 5.2 percent in the fourth quarter of 2023-24.

India’s merchandise exports grew by 3.7 per cent on a m-o-m basis, reaching a 9-month high of US$ 38.4 billion in March 2023.

On a y-o-y basis, exports registered a contraction of 13.9 per cent due to an unfavourable base effect. Overall, merchandise exports reached an all-time high of US$ 447.5 billion.

India registered record exports of defence goods in 2022-23, with exports having risen ten-fold in a span of seven years leveraging on policies such as “Atmanirbhar Bharat”.

Recent initiatives, including the introduction of an open general export license policy, simplified end-to-end online export authorisation and establishment of defence industrial corridors augur well for India’s defence exports going forward.

Merchandise imports at US$ 58.1 billion in March 2023 recorded a positive momentum of 9.1 per cent.

On a y-o-y basis, however, they contracted for the third consecutive month on account of a large base effect.

GST collections for the month of April 2023 was at Rs 1.87 lakh crore, the highest ever.

Inflation:

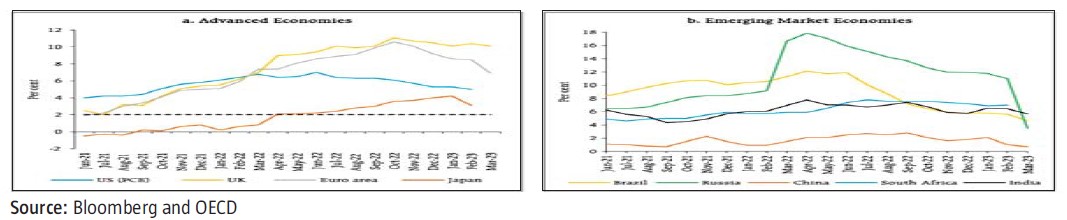

Global: Consumer price inflation has slowed from recent highs in most economies, owing to lower energy prices and easing supply chain bottlenecks; but core inflation has remains stubborn.

Despite recent softening, headline inflation remains well above target in most AEs and EMEs.

US headline CPI inflation (y-o-y) eased markedly to 5.0 per cent in March 2023 from 6.0 per cent in February – the lowest level since May 2021 – due to a favourable base effect.

In the Eurozone, inflation dropped significantly in March 2023 to 6.9 percent from 8.5 percent the previous month, owing to negative momentum in the energy sub-component.

In the UK, however, inflation inched up to 10.4 per cent in February 2023 from 10.1 per cent in January, with high monthly price momentum in food and non-alcoholic beverages.

Japan’s CPI (all items less fresh food) inflation eased to 3.1 per cent in February from an over-40-year high of 4.2 per cent in January 2023.

Among the EMEs, inflation eased further in Brazil (4.7 per cent), and China (0.7 per cent) in March 2023 while it increased marginally in South Africa in February 2023. In Russia, it fell sharply to 3.5 per cent in March 2023 driven by base effects.

India: CPI inflation moderated to 5.7 per cent in March 2023 from 6.4 per cent in February. The decline was broad-based across major groups viz., food, fuel, and core (excluding food and fuel). The fall in headline inflation by 78 bps between February and March was on account of a large favorable base effect (96 bps), which more than offset a positive price momentum of around 23 bps during the month.

Trends and Drivers of CPI Inflation:

Bond Yields & Spreads:

US FED hiked rates by 25bps in May 23 FOMC (Federal Open Market Committee), following a similar hike in Mar/Feb ‘23, despite banking sector stress, indicating that inflation remains top priority. However, the FOMC has indicated that they would likely pause, though continue to watch inflation trajectory. No rate cuts are envisaged by the FOMC in 2023

ECB hiked by 50bps with the Bank of England (BoE) hiking by 25bps.

In a surprise move, RBI paused in the first policy of FY2024, keeping rates steady at 6.50%. Markets now expect RBI to remain in pause mode for a rest of 2023.

US 10Y yield continued to drop in April, falling to 3.42% as contagion fears from the banking stress engulfed global markets as well expectation that FED will likely pause post May 23 rate hike. India rates dropped sharply on RBI MPC’s surprise hold. 10Y GSEC dropped to 7.12% at April end as overall global rate sentiment aided markets. Drop in inflation to below 6% further aided sentiment.

Overall yield curve dropped lower with flattening bias as long-term rates dropped more on back of RBI’s pause. Short term rate drop was limited as overnight rate continue to remain in 6.50-6.75%. Medium to long term corporate spreads remained on lower side in absence of any material increase in supply.

Outlook:

Global: Global economy is likely to be marked by slow growth, moderating but elevated inflation, peaking policy rates, and continuing geo-political risks.

Recent spate of bank failures in the US and takeover of Credit Suisse by UBS has added to global angst.

Further news of stress in regional banks in the US continues to rattle investors

Inflation seems to have peaked in major countries, though reasons to cheer may still be far away.

US FOMC has indicated a pause in the rate hike cycle while other central banks like ECB and BoE may still have more work to do.

While rate hikes in major countries seem to have ended, rates may have to remain higher for longer to bring down inflation to mandated levels.

Markets will now try to assess the timing of rate cuts, especially on the back of continuing bank crisis and threats of recession in AEs.

Overall rate markets should benefit from haven flows from geo-political concerns as well impending rate hikes, probably by end of 2023

India: In India, macro situation is better. Growth while remaining resilient is likely to slow down to below 6% in FY2024.

Inflation downtrend has started, with 1Q FY2024 inflation likely nearer 5%.

RBI MPC surprised markets by pausing rate hikes, citing global financial stability concerns and the need to assess the impact of cumulative tightening already delivered in last 1 year. We now expect RBI MPC to go for a longish pause and watch the evolving inflation dynamics.

With RBI projecting inflation to be 5.2% for FY2024, it remains above their 4% medium term policy target, giving them little room for easing action.

Global rate scenario has turned benign in wake of banking stress and contagion risk. If global inflation continues to moderate, as expected, rate easing may start earlier than expected, possibly by end of 2023.

Markets have rallied post policy, with the curve steepening as short-term rates drop more than longer term rates. 10Y GSEC rates are near 7%, and the downside may remain limited in absence of any rate easing expectations in the near term. Markets are likely to consolidate from here. Market movements may depend on global cues, supply- demand of local bonds in the market, oil price movements and inflation trajectory. 10Y G-SEC may trade in 6.90-7.15% range.

Source: RBI, MOSPI, CMIE, FIMMDA, NSDL, Bloomberg.