Economic Indicators (as on November 30, 2023)

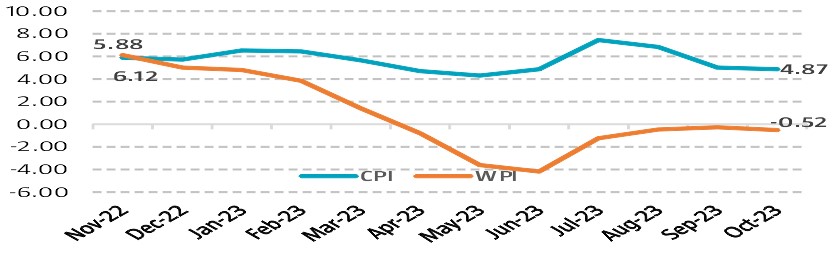

Inflation in India (%)

Consumer Price Index eased to 4.87% in Oct’23, lowest in 5 months, from 5.02% in Sep’23, thanks to the combination of a favourable base effect and cooling prices of some food items. Retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) is -0.52% in Oct’23 from -0.26% in Sep’23, it remained negative for the 7th consecutive month but the contraction was narrower compared with the previous months due to a mild uptick in crude oil, natural gas and power prices.

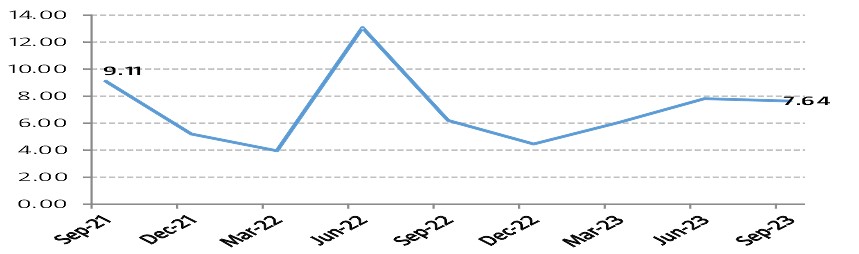

Index of Industrial Production (%)

Index of Industrial Production (IIP) falls to 3 months low of 5.8% in Sep’23 from 10.3% in Aug’23 due to a significant deceleration in key sectors namely manufacturing sector growing by 4.5%, mining sector growing by 11.5% and electricity growing by 9.9%.