Economic Indicators (as on September 30, 2022)

Inflation in India (%)

Consumer Price Index snapped out its 3 months downward trend and increased to 7% in Aug’22, from 6.71% in Jul’22 due to spike in food prices. The current level of inflation continues to remain above 6% mark for the eigth consecutive month. Wholesale Price Index (WPI) decreased to 12.41% in Aug'22 from 13.93% in Jul'22 amid a slowdown in prices crude and manufactured products. The current level of inflation continues to rise above RBI’s limit of 4%-6% in response to rise in prices of mineral oil, natural gas, basic metals, chemicals and chemical products, food articles etc.

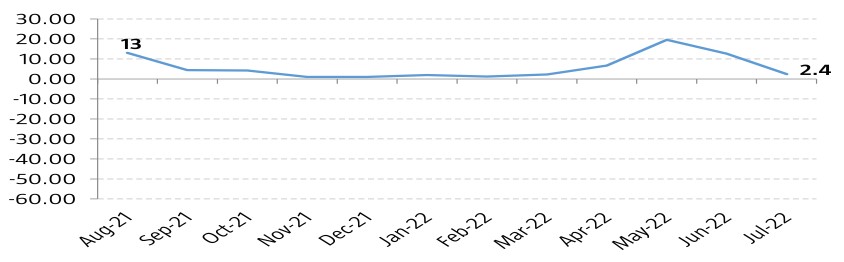

Index of Industrial Production (%)

ndex of Industrial Production (IIP) fell to 2.4% in Jul’22 from 12.7% in Jun’22 showing the weakest increase in industrial activity since March. The electricity sector, manufacturing and mining sector rose by 2.3%, 3.2% and 3.3% respectively in Jul'22