Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

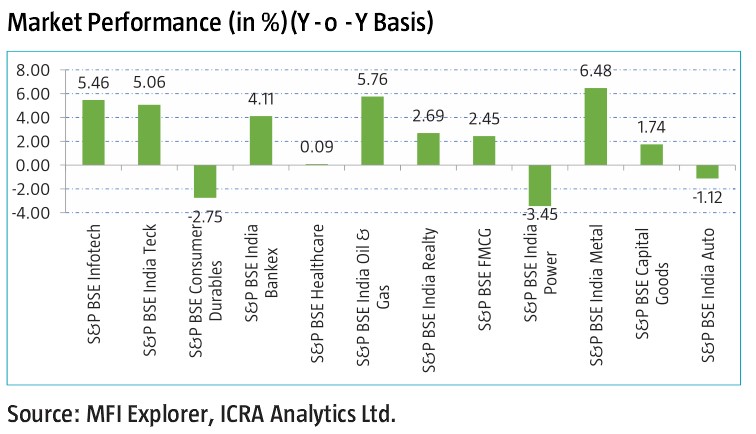

- In the month of Nov'22, equity markets went north with Nifty 50 rising by 4.14% m-o-m basis majorly led by strong corporate earning numbers for the quarter ended Sep'22 and decline in global crude oil prices. Firm global cues along with the strong foreign fund inflows helped to uplift the market sentiments.

- Foreign Institutional Investors (FIIs) were net buyers in Indian equities to the tune of ₹36238.63 crores

- Goods and Services Tax (GST) collection shows that ₹1.45 lakh crore were collected for Nov'22, which is 11% more than the corresponding period of last year. This is the ninth straight month when collections from GST has remained above ₹1.40 lakh crore.

- During the Month, markets witnessed some correction in the first half as some Mid Cap and Small Cap companies saw losses for the quarter. Market participants preferred to book some profits and

repositioned themselves which also lead to some fall. Global inflation concerns kept market participants on tenterhooks. A major rating agency reduced India's projected economic growth for 2022.

- Government Data showed that the India's core sector growth dropped to 0.1 per cent in October in comparison to 8.7 per cent in the same month last year.

- Globally, US equity markets also went up during the month U.S. Federal Reserve monetary policy review held in Nov'22 showed that the U.S. central bank might slow down the pace of rate hikes moving ahead, upbeat quarterly reports of multiple big companies also made it rise back up and end in green. Despite hopes that the U.S. Federal Reserve may slow down the pace of rate hikes in the coming months providing some support to the markets, Asian Equity Markets closed on a mixed note due to Covid-19 restrictions again imposed in China as well as U.S. administration imposing export controls on China. On the other hand, European Markets rose, coupled with hopes of the new British Prime Minister leading Britain out of an economic crisis further boosting market sentiments and U.K. retail sales came better than expected for Oct'22.

Equity Market Outlook

The global environment remains adverse, though inflation might have peaked, based on the latest inflation data in US. The latest comments from Fed about possible slowing pace of increase in the interest rates is comforting. However, the interest rates are likely to remain at elevated level of 4.5-5%, till inflation shows serious moderation. Combination of slowing growth but yet sticky inflation is an outcome of elevated energy prices and challenged supply chains in China, which are taking time to correct itself. Geopolitical tensions are taking time to abate and are only getting complex with Ukraine regaining lost ground on war front. Given these tensions, supply chains and global trade has become vulnerable to new dimension which were missing till 2022. In our worldview, 1) the Liquidity, 2) Growth and 3) Inflation surfaced post monetary and fiscal expansion in 2020 in that order and they might reverse in the same order during CY22/23. We are already witnessing liquidity reversal since last few quarters; growth has started receding lately (Europe is already in recession, US is slowing) and inflation might be the last one to moderate. We saw the first downtick in inflation just now. Inflation is taking more time than usual to recede given elevated energy prices, tight labor markets and challenged supply chains in China. In-turn, further interest rate increases become imperative - expect additional 100bps increase through next 6months to 4.5%-5% in US – and remain there for some time.

This environment would have implications for emerging markets including India in the form of 1) Heterogeneous flows, 2) higher cost of capital and 3) impact on exporting sector growth. We believe that the inflation and energy equation might adjust itself over next 6-9 months (unless we get a full-fledged European/Asian conflict, which is low probability event in our view). This is expected to happen despite Russia being large supplier of Gas and oil, as money supply reduces and growth moderates. Expect sizable growth moderation in developed world over next 4 quarters, as impact of lower liquidity, zero fiscal support, higher energy prices and higher cost of capital plays through in underlying economy.

On domestic front, India has outperformed most EMs on earnings and index return front over last 4 quarters sizably. Indian market has recovered post sharp pull back of ~15% in July/August and valuation are no more inexpensive, given modest earnings moderation lately. India is more sensitive to energy prices as compared to most of its peers. With oil still at >US$90 (adjusted for INR depreciation), the Current Account Deficit can deteriorate by >1.5% for FY23 to 3-3.5%, depending upon the period of elevated energy prices, putting pressure on inflation and currency. RBI has used reserves as first line of defense for currency, and thus interest rates increase might now be higher towards 6-6.5% as compared to earlier expectation of increase till 6% repo rate. Expect inflation to range above 6% through the next 2-3 quarters before moderating. Clearly, we are vulnerable – if this is sustained for a longer period. If energy prices correct the way they have been during last few weeks, we might see faster moderation of inflation and lower need to increase interest rates.

Having said that there are no macro worries, given >US$530bn of forex and > US$30-50bn of FDI annually plus strong remittances. We are working with a base case that the energy prices will adjust within the next 2-3 quarters and thus the impact on economy and earnings would be far less than what market is projecting. India story remains constructive if the energy prices moderate in a shorter time frame than anticipated.

While in near term there are challenges; equity outlook from medium term perspective remains constructive for India. We see several factors which are constructive viz. 1) Corporate earnings are expected to be healthy over 2-3 years with nominal GDP growth at 10-11% CAGR, 2) Government has shifted focus to growth despite fiscal constraints – visible in Govt/PSU capex numbers – benefited by higher than expected tax revenues for FY23 , 3) Exports while will moderate, are still likely to be resilient in pockets, 4) Bank and Corporate balance sheets have gone through de-leveraging over last 6-7 years and are ready for growth as environment stabilizes and 5) discretionary consumer demand remains healthy– visible in Auto, Retail, Real estate, Travel etc. All these factors indicate a conducive growth environment as compared to the past few years on domestic front through next 3-5 years.

At the aggregate level, the nifty earnings growth estimates for FY23/24 have remained unchanged with 12-14% CAGR, respectively. After a span of five years, we have witnessed earnings upgrades through 2HFY21/22. The earnings upgrade cycle has taken a pause in 1HFY23 due raw material price pressures – after 6 consecutive quarters of earnings upgrade of ~25%. The earnings upgrades cycle has moved to domestic cyclicals from exporting sectors. The earnings upgrade cycle has firmly shifted from externally focused sectors like IT, Commodities/other exporters towards domestically focused sectors like Financials, Discretionary, auto, Industrials, Housing etc. Assuming the energy prices moderate to <US$80 within next 3-6 months, this cycle could convert into a full-fledged business and credit cycle for next 3 years. Given this context, the portfolios have also gradually been aligned to sectors where the earnings upgrades are likely to happen over the next 2 years, the domestic cyclicals.

Nifty is trading at 20xFY24 on consensus earnings, in a fair valuation zone from medium term perspective, assuming earnings downgrades are not substantial in FY23/24. The current uncertainty is good medium term valuation entry point for Indian market in our view, given that most domestic enablers are in place, and we are underway a cyclical upturn in domestic economy and earnings.

Key risk still appears to be on 1) Earnings downgrades, if energy prices remain elevated for longer period than anticipated, 2) stagflation, 3) Escalation of war and 3) Negative impact on domestic growth and due to longer and higher global inflation/interest rates.

Source: ICRA MFI Explorer