Economic Indicators (as on November 30, 2022)

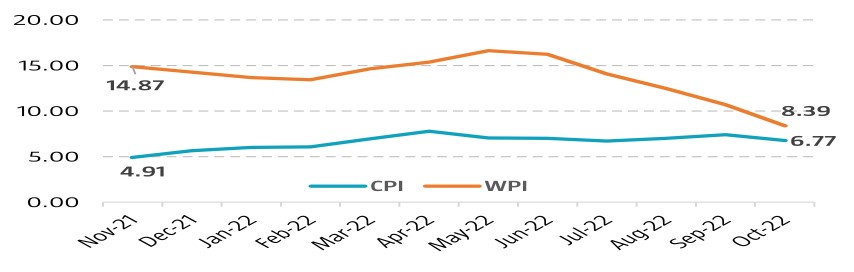

Inflation in India (%)

Consumer Price Index decreased to 3-month low, 6.77% in Oct’22 from 7.41% in Sep’22 due to decline in prices of vegetables, fruits, pulses and oil. The current level of inflation continues to remain above the 6% mark for the ninth consecutive month. Wholesale Price Index (WPI) decreased to 8.39% in Oct'22 from 10.70% in Sep'22, lowest since Mar'21, primarily contributed by fall in the price of basic metals, crude oil and manufactured products. The current level of inflation continues to rise above RBI’s limit of 4%-6%.

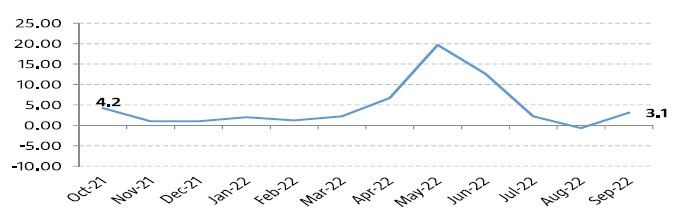

Index of Industrial Production (%)

Index of Industrial Production (IIP) rose to 3.1% in Sep’22 from -0.8% in Aug’22 primarily owing to a rise in manufacturing and mining outputs. The electricity sector rose by 11.6%, whereas the manufacturing and mining sectors increased by 1.8% and 4.6% respectively in Sep'22.