Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Global Economy Update:

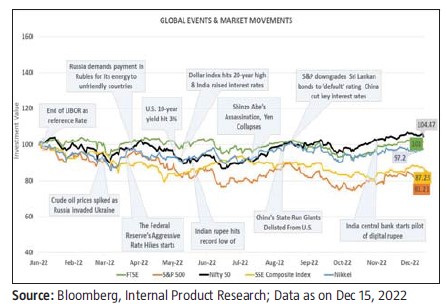

2022 may be remembered as a watershed moment in global history, signalling the end of one era and the beginning of another. The year saw major

geopolitical and economic events that shaped various countries' international relations and economies. The year saw major historical events ranging

from the funeral of Queen Elizabeth II to the assassination of former prime minister of Japan, Shinzo Abe, to Liz Truss who resigned as UK prime

minister after 45 days in office. Global economies were shellshocked with Russia declaring war against Ukraine which resulted in a major energy crisis

as besides the middle eastern countries, Russia has a major share in crude oil export. The demand supply mismatch resulted towards global inflation

shooting upwards across economies and disturbed the financial equilibrium.

Factors that were going to break the backs of the Indian stock market indices included the conflict between Russia and Ukraine, which caused fluctuations in crude oil prices, the rupee's weakness, problems with the global supply chain brought on by the pandemic, and the staggering inflation that was well above the consumer price index (CPI) inflation of 4% within a range of +/- 2% set by the Reserve Bank of India. Instead, it has been the opposite. As of December 15th, the Nifty 50 had generated 4% absolute returns, compared to theUS Nasdaq, which had dropped by30% due to global headwinds. India's significant GDP growth of 6.3% year on year in Q3 2022, compared to the US's stagnant 1.9%, which was driven by a steady expansion in private consumption and strong growth in investments, partially offsetting lower government spending and a higher trade deficit could be attributed for the outperformance of the domestic market in comparison to the developed economies.

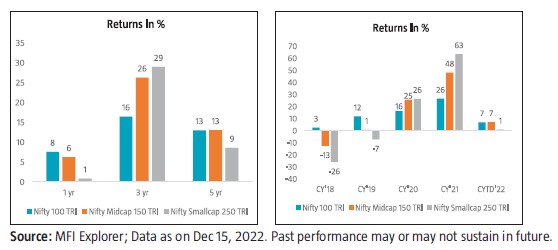

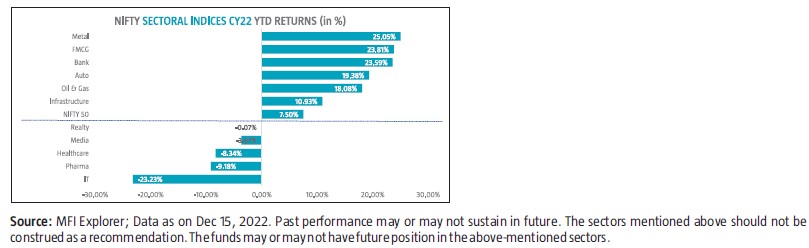

Overall, on a broader scale, Nifty 50 TRI has given a return of 7.5% backed by reduction in covid cases and thereby opening up of economy in truest sense after 2 long years leading to strong pent-up demand. This helped corporate revenue growth leading to increase in credit growth and good GST collection numbers.On a sectoral level, Nifty Metal is the best performer because of constraints on supply side due to Russia-Ukraine war, whereas the Nifty IT Index is the worst performer so far in CY'22 as rising interest rates increased concerns of global economic slowdown and could result in curtailment in IT spending by corporates.

Outlook:

The rate of macro growth is strong and economic activities are closer to the pre-pandemic level. Government spending has resumed, employment is on the rise, and supply bottlenecks are lessening, which should somewhat offset the negative effects of the lagging effect of rate hikes. The Indian economy should be supported in the medium term by stable political scenario, favourable policy environments, the effects of PLI programmes, possibilities brought about by changes in the global supply chain, government emphasis on infrastructure spending, etc.Weanticipate easing of the lag effect caused by the rise in global commodity prices, both for food and non-food items.

The ongoing rebound in FPI inflows may be short-lived, as falling global growth can alter their risk appetite. Though DII flows are as meaningful as FPI flows, with retail flows increasingly being directed in markets through Insurance, EPFO and MFs. Current monthly SIP Book of MFs in India is ~13,000 Cr should provide good support to the markets in casewewitness continued FII withdrawals.

GDP Growth is expected to normalize over the coming quarters. Additionally, lower crude oil prices should begin contributing positively to terms of trade. However, downside risks are increasing from global factors and the lagged impact of monetary tightening.

For the first time since Russia invaded Ukraine in late February, oil prices have dropped below $80 per barrel. However, given that there appears to be a great deal of uncertainty regarding Russian oil supply coupled with EU's ban on Russian crude oil and OPEC+ supply restrictions, and US supply growth will not be able to fill the gap,wethink Brent crude will once more reach $100 per barrel.

As the cost of funds rises and supply chain bull-whips continue to unwind, exports are likely to be pressured, reducing the momentum from

normalising employment and the restart of general government spending.