Economic Indicators (as on December 30, 2022)

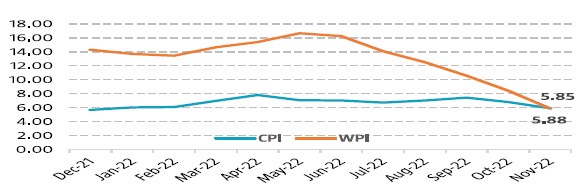

Inflation in India (%)

Consumer Price Index dropped to 11-month low, 5.88% in Nov’22 from 6.77% in Oct’22 due to decline in prices of vegetables, fruits, and onions. The current level of inflation has dropped to its lowest and below the 6% mark for the first time in this calendar year. Wholesale Price Index (WPI) decreased to 5.85% in Nov’22 from 8.39% in Oct'22, lowest since Mar'21, primarily contributed by fall in the price of basic metals, chemical and chemical products, and paper and paper products. The current level ofinflation has dropped below RBI upper limit of 6% for the 1st time since Feb’21.

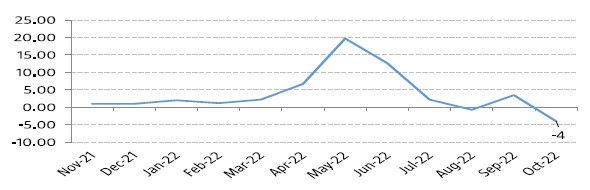

Index of Industrial Production (%)

Index of Industrial Production (IIP) dropped to -4% in Oct’22 from 3.1% in Sep’22

primarily owing to a contraction in manufacturing outputs and subdued growth in

mining and power generation. The electricity and mining sectors rose by 1.2% and

2.5% respectively, whereas the manufacturing sector decreased by 5.6 respectively in

Oct'22.