Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

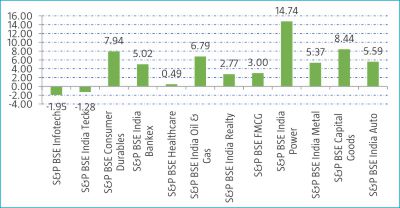

- In the month of Aug’22, equity markets went up with Nifty 50 growing by 3.50% m-o-m basis majorly led by fall in global crude oil prices and a rebound in foreign fund inflows in the domestic equity market. Upbeat domestic corporate earning numbers for the quarter ended Jun'22 also contributed to the upside.

- Foreign Institutional Investors (FIIs) were net buyers in Indian equities to the tune of Rs.51204.34 crore this month.

- Goods and Services Tax (GST) collection shows that Rs. 1.44 lakh crore collected for Aug'22, which is 28% more than the corresponding period of last year. GST collection has crossed Rs 1.25 lakh crore mark for the eleventh consecutive time.

- During the month, markets witnessed some correction over fears of a looming recession dampened market sentiments. Some degree of profit booking too contributed to the overall weakness in the bourses. Equity markets under pressure as U.S. Federal Reserve chief at a global central bank conference in Jackson Hole, Wyoming indicated that the U.S. central bank will continue to raise interest rates to fight inflation. A major global credit rating agency lowered its gross GDP growth forecast for India to 7.7% for 2022. A surging dollar index also acted as a headwind for the markets.

- India's gross domestic product (GDP) grew 13.5% on a yearly basis for the quarter ended Jun,22 as compared to a growth of 20.1% in the same period of the previous year. Government data showed that the combined index of eight core industries grew 4.5% in Jul'22 as compared to a growth of 13.2% in Jun'22 and a growth of 9.9% in Jul'21.

- However, during the month, some value buying was seen as correction in global crude oil prices from the recent peaks provided some respite to market participants. Improved corporate tax collections during FY'22 and vigorous GST collection data raised expectations over economic recovery.

- Globally, equity markets remained slightly on a negative zone in Aug’22 as U.S. Federal Reserve Chief and other officials indicated that the U.S. central bank will continue to tighten its monetary policy at an aggressive pace to combat rising inflation in U.S. European markets s fell on growing prospect of recessions in the euro zone and the U.K. Asian markets remained a bit under pressure over concerns about economic growth rising COVID-19 infections in China.

Equity Market Outlook

Global environment remains volatile with inflation remaining sticky and at elevated levels and growth slowing down - as an impact of increase in interest rates, tightening of liquidity and elevated energy prices along with challenged supply chains due to COVID restrictions in China. Geopolitical tensions are taking time to abate in Europe and now in Asia too. Given these tensions; supply chains and global trade has become vulnerable to new dimension missing till 2022. In our worldview, 1) the Liquidity, 2) Growth and 3) Inflation surfaced post monetary and fiscal expansion in 2020 in that order and they will reverse in the same order. We are already witnessing liquidity reversal since last few quarters; growth has started receding lately and inflation will be the last one to moderate. Inflation is taking little more time than usual to recede given elevated energy prices, tight labor markets and challenged supply chains in China. In-turn, the interest rate increases become imperative - expect additional 100-150bps min increase through the year to 3.5-4% in US.

This environment would have implications for emerging markets including India in the form of 1) Hostile flows, 2) higher cost of capital and 2) impact on exporting sectors. We believe that the inflation and energy equation will adjust itself over next 6-9 months (unless we get a full-fledged European/Asian conflict, which is low probability event in our view). This is expected to happen despite Russia being large supplier of Gas and oil, as money supply reduces and growth moderates. Expect sizable growth moderation in developed world over next 4-6 quarters, as impact of lower liquidity, no fiscal support, higher energy prices and higher cost of capital plays through, in underlying economy.

On domestic side, India has outperformed most EMs on earnings and index return front over last 4-6 quarters. Indian market was already in valuation moderation mode for last 9 months, buy has seen a sharp pull back of ~15% in July/August. India is more sensitive to energy prices as compared to most of its peers. With oil at US$100, the CAD can deteriorate by >1.5% for FY23 to 3-3.5%, depending upon the period of elevated energy prices, putting pressure on inflation and currency. Inflation pass-through would also be at least 50-75bps over next 3-6 month, if this persists. Expect inflation to range above 6% through next 2-3 quarters before moderating. Clearly, we are vulnerable – if this sustains for longer period. If energy prices correct the way they have been during last few weeks, we might see faster moderation of inflation and lower need to increase interest rates.

Having said that there are no macro worries, given >US$560bn of forex and > US$30-50bn of FDI annually. We are working with a base case that the energy prices will adjust itself within next 2-3 quarters and thus the impact on economy and earnings would be far less than what market is projecting. India story remains constructive, if the energy prices moderate in a shorter time frame than anticipated.

While in near term there are challenges; equity outlook from medium term perspective remains constructive for India. We see several factors which are constructive viz. 1) Corporate earnings are expected to be healthy over 2-3 years with nominal GDP growth at 10-11% CAGR, 2) Government has shifted focus to growth despite fiscal constraints – visible in Govt/PSU capex numbers – benefited further by tax revenues running ahead of expectations , 3) Exports while will moderate, are still likely to be resilient in pockets, 4) Bank and Corporate balance sheets have gone through de-leveraging over last 6-7 years and are ready for growth – visible in sector like Industrials, Cement, Metals, Chemicals etc. and 5) discretionary consumer demand remains healthy– visible in Auto, Retail, Real estate, Travel etc. All these factors indicate a conducive growth environment as compared to past few years on domestic front.

At aggregate level, the earnings growth estimates for FY23/24 have remain unchanged with 13-15% CAGR growth, respectively. The earnings upgrades have been largely in exports sectors between FY21-22 and is likely to move to domestic cyclicals like Industrials, Banks, consumer discretionary over next 3 years. The earnings upgrade cycle has taken a pause in Q4FY22/Q1FY23 due raw material price pressures – after 6 consecutive quarters of earnings upgrade of ~25%. After a span of five years, we have witnessed earnings upgrades through last 6-8 quarters. We expect the earnings upgrade cycle to shift from externally focused sectors like IT, Commodities/other exporters towards domestically focused opening-up sectors like Financials, Discretionary, auto, Industrials, Housing etc. (assuming the energy prices moderate back to below US$85-90 within next 3-6 months). Thus, the portfolios have also gradually being aligned to sectors where the earnings upgrades are likely to happen over the next 6-12 quarters – which are domestically focused opening-up beneficiary sectors.

Nifty has moved up by ~15% in July/August and is trading at 18xFY24 on consensus earnings, in a fair valuation zone from medium term perspective, assuming earnings downgrades are not substantial in FY23/24. The current uncertainty is good medium term valuation entry point for Indian market in our view, given that most domestic enablers are in place, and we are underway a cyclical upturn in domestic economy and earnings.

Key risk still appears to be on 1) Earnings downgrades, if energy prices remain elevated for longer period, 2) stagflation, 3) Geopolitics and 3) Negative impact on growth and due to higher-than-expected inflation for longer period.

Source: ICRA MFI Explorer