Economic Indicators (as on August 30, 2022)

Inflation in India (%)

Consumer Price Index is at a 5-month low as it reduced to 6.71% in Jul’22, from 7.01% in Jun’22 due to mderation in food prices. Also, the low base of last year, when the data was computed with a low response rate contributed to this level of inflation. The current level of inflation continues to remain above 7% mark for the third consecutive month and marking completion of the second quarter. Wholesale Price Index (WPI) decreased to 15.18% in Jun'22 from 15.88% in May'22 as crude prices reduced. The current level of inflation continues to rise above RBI’s limit of 4%-6% in response to rise in prices of mineral oil, natural gas, basic metals, chemicals and chemical products, food articles etc.

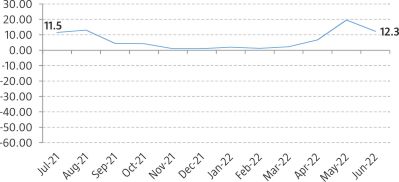

Index of Industrial Production (%)

Index of Industrial Production (IIP) fell to 12.3% in Jun’22 from a twelve months high of 19.6% in May'22 powered mainly by higher electricity and manufacturing output.Improving IIP is quite indicative of the ongoing economic recovery. The electricity sector, manufacturing and mining sector rose by 16.4%, 12.5% and 7.5% respectively in Jun'22.